Job Description

Practice: Executive Compensation, Employment & Benefits

Experience: Minimum of 5 years

QUALIFICATIONS

The Latham Tax Department is conducting a national search for attorneys with a minimum of 5 years of executive compensation and employee benefits experience. Qualified candidates will have significant experience in company representation and compensation disclosure issues and a broad array of transactional executive compensation and benefits matters (and the tax, securities and other relevant law associated with such matters).

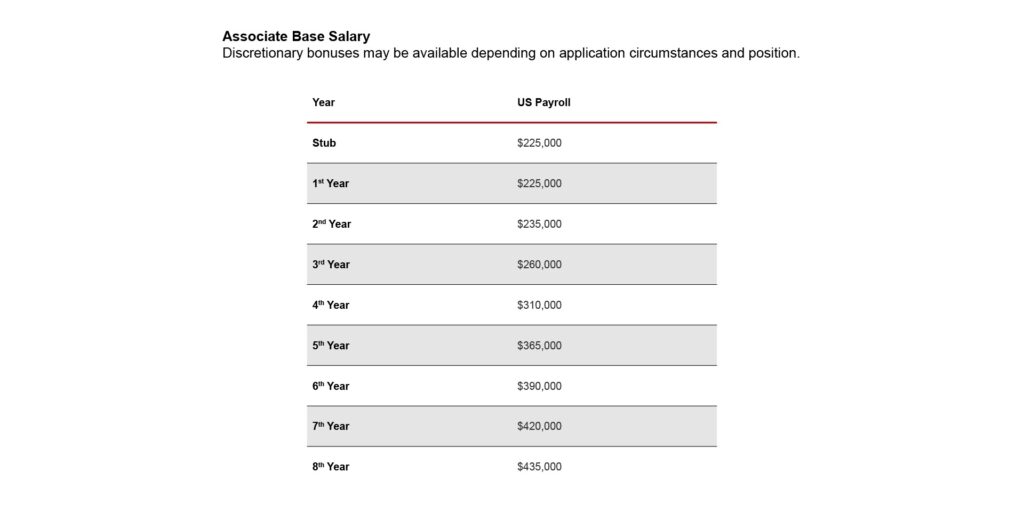

Associate Base Salary

Discretionary bonuses may be available depending on application circumstances and position.

__

Note: Lateral Hub does not accept applications submitted by search firms.