Job Description

Experience: Minimum of 3 years of experience

Qualifications

Candidate should have experience with renewable energy tax credits, including financings and M&A pertaining to wind energy, solar energy projects, carbon capture and sequestration and other major energy transition projects. Ideal candidate will have experience that includes documenting and negotiating tax equity transactions for sponsors and/or tax equity investors, familiarity with partnership tax rules, and experience drafting and negotiating tax provisions of partnership agreements, credit agreements and related documentation for clients in the U.S. power sector and energy transition sector. An ideal candidate would also have some tax background in general M&A transactions as well.

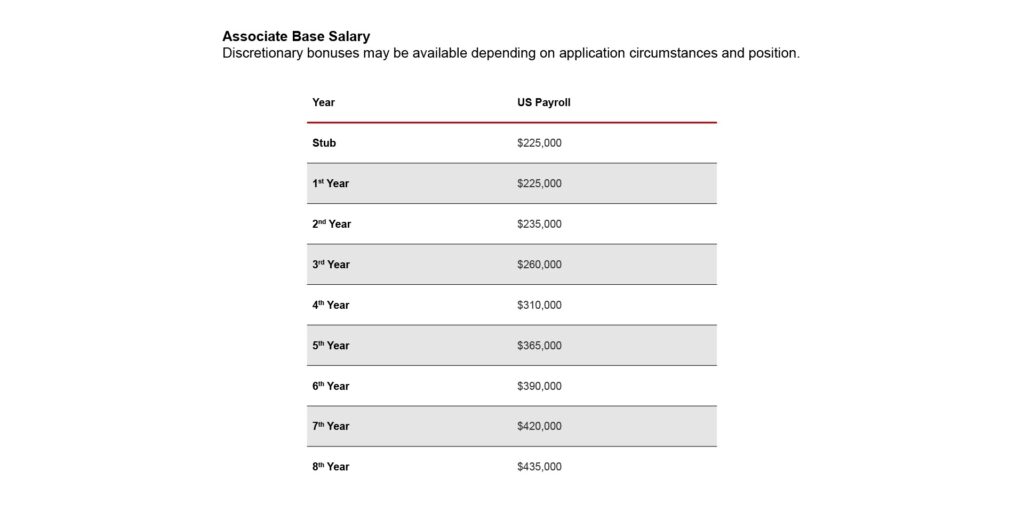

Associate Base Salary

Discretionary bonuses may be available depending on application circumstances and position.

__

Note: Lateral Hub does not accept applications submitted by search firms.